Non-weather water claims: is your portfolio at risk?

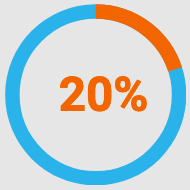

On average, 1 in 15 homeowners will experience damage that results in a non-weather water claim during the standard five year policy lifecycle. Pinpointing which policy is at greatest and least risk for a claim is tricky. The probability of a claim varies dramatically across the country, and even from location to location over a short distance.

| The Risky Business of Non-Weather Water Claims | ||||||||||||||||

1 in 15

| National average number of homeowners who will experience damage that results in a non-weather water claim during the standard five year policy lifecycle. | ||||||||||||||||

National Claims Risk Variance Range for Non-Weather Water

| |||||||||||||||||

Top 3 States with the Highest Claim Risk for Non-Weather Water Statewide

Even within the highest risk states, claims risk varies: often from even less than the national average, to 2-3 times as likely as the statewide claim probability. | |||||||||||||||||

Top Counties (within the Top 3 States) with the Highest Claim Risk for Non-Weather Water Statewide

Even within the highest risk county in each of the highest risk states, the claims risk varies: sometimes from 2-3 times as likely, down to less likely than the national average. | |||||||||||||||||

Probability of a claim is during the standard policy life expectancy of 5 years. Probabilities are based on claims per 1,000 earned exposures. Scores are validated with 3.5 million earned exposures. | |||||||||||||||||

The cost to insurers

Pipes burst, valves fail, and appliances malfunction. These are just some of the non-weather water events that can lead to costly damage and claims. Far from rare, these instances, and the cost to insurers, add up.

Some of the Common Culprits of Non-Weather Water Damage

| ||||||||||||

Non-Weather Water Costs Add Up

| ||||||||||||

*Source: Location, Inc.’s analysis of insurance carrier loss data, corroborated by third-party industry data from the Insurance Journal and the Insurance Information Institute. Losses = $41.2B net of Reinsurance. | ||||||||||||

How can insurers avoid non-weather water claims and losses?

By knowing the risks for any particular location during underwriting, you can write non-weather water coverage more profitably. See the likelihood of a non-weather water claim for any address with our exclusive claim probability tool.