WaterRisk™

The first and only predictor of non-weather water claims.

TRY ITProbability of a Water Claim

Non-weather water damage accounts for approximately 20% of all property insurance losses – both in homeowner’s and commercial lines.

From appliance, heating, and air conditioning system failures to fixture leaks and restroom overflow, non-weather water damage is clearly a large problem. Yet it continues to persist. Why? Unlike losses due to Mother Nature, non-weather water damage has a diversity of causes—and the data on these causes, while predictive, are difficult to collect.

Predicting non-weather water claims has been difficult. Until now.

WaterRisk looks at the disparate causes of non-weather water damage and their complex interactions to predict the probability of a claim and losses —for any address nationwide. Discover how WaterRisk can dramatically improve your underwriting results today.

- Homeowner's Insurance

- Commercial Insurance

Introducing WaterRisk™ by Location, Inc.

Non-weather water damage is responsible for approximately $8.24B per year in homeowner’s insurances losses.1 Unlike losses due to Mother Nature, non-weather water damage has a diversity of causes (Figure 1)—and the data on these causes, while predictive, are difficult to collect.

How does non-weather water damage affect your underwriting efforts?

WaterRisk is the first and only predictor of non-weather water claims.

Built from a broad, diverse and proprietary national database, WaterRisk looks at the disparate causes of non-weather water damage and their complex interactions to predict the probability of a claim and losses due to non-weather water—for any address nationwide.

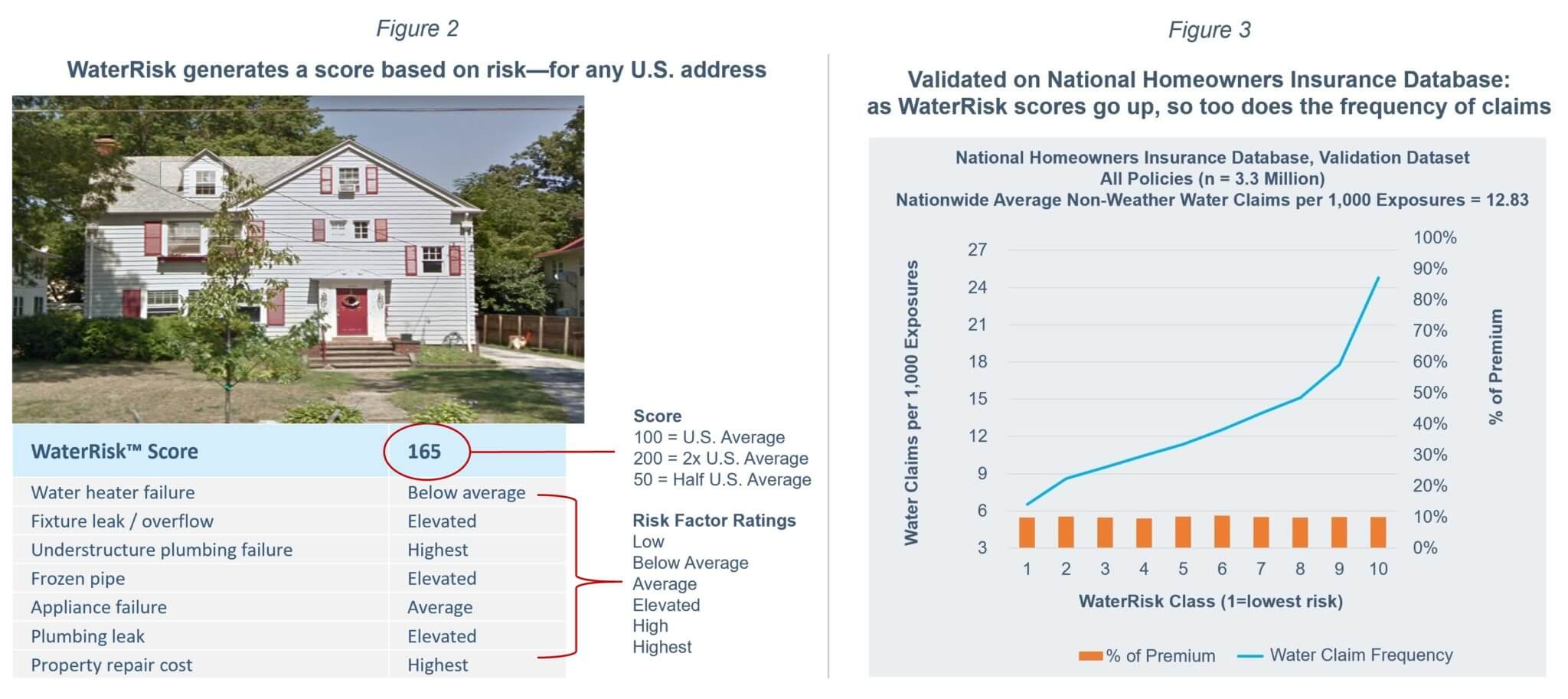

WaterRisk generates a score based on risk—for any U.S. address. This Lakewood, OH-area address (Figure 2) has a WaterRisk score of 165, which is 65% above the national average score of 100. Listed with the score are factors that contribute to the non-weather water damage risks at the address, to help convey some of the primary reasons why the risk is higher.2

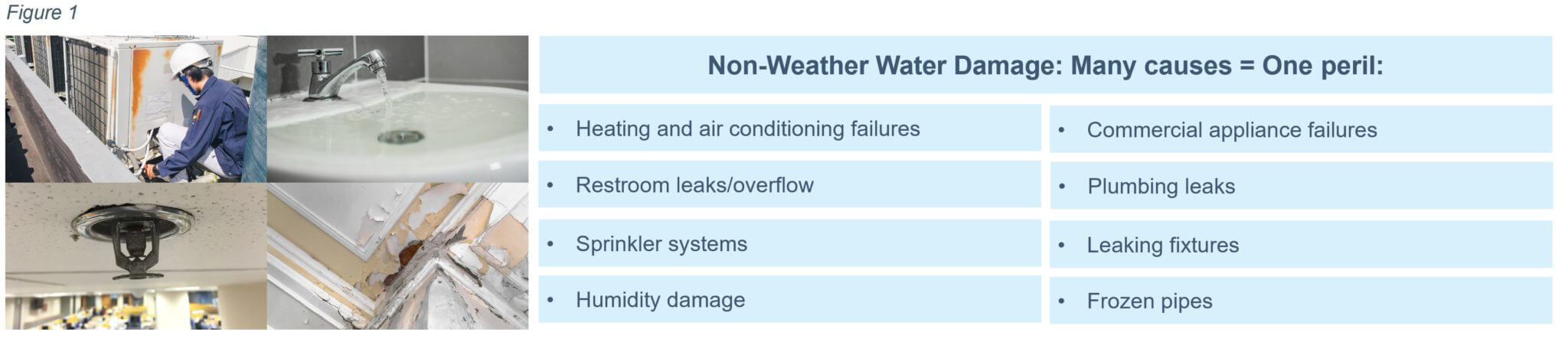

WaterRisk is highly predictive of the frequency and losses from non-weather water damage claims, and has been validated by Location, Inc.’s exclusive national insurance industry database (Figure 3): as the WaterRisk score increases, so too does the frequency of claims. As a result, WaterRisk fills an unquantified gap that accounts for about 20% of all homeowner’s losses.

What WaterRisk can do for you

REQUEST YOUR COMPLIMENTARY PORTFOLIO RISK EXPOSURE ANALYSIS

DISCOVER HOW WATERRISK™ CAN DRAMATICALLY IMPROVE YOUR UNDERWRITING RESULTS

GET STARTED NOW1. Location, Inc.’s analysis of insurance carrier loss data, corroborated by third-party industry data from the Insurance Journal and the Insurance Information Institute. Losses = $41.2B net of Reinsurance.

2. WaterRisk is not a sub-score based index; the factors that contribute to non-weather water damage risks are listed simply to help convey why the risk is low or high for an address but do not quantitatively sum to the WaterRisk score.

Introducing WaterRisk™ by Location, Inc.

Non-weather water damage is responsible for approximately $3.57B per year in commercial property losses.1 Unlike losses due to Mother Nature, non-weather water damage has a diversity of causes (Figure 1)—and the data on these causes, while predictive, are difficult to collect.

How does non-weather water damage affect your underwriting efforts?

WaterRisk is the first and only predictor of non-weather water claims.

Built from a broad, diverse and proprietary national database, WaterRisk looks at the disparate causes of non-weather water damage and their complex interactions to predict the probability of a claim and losses due to non-weather water—for any address nationwide.

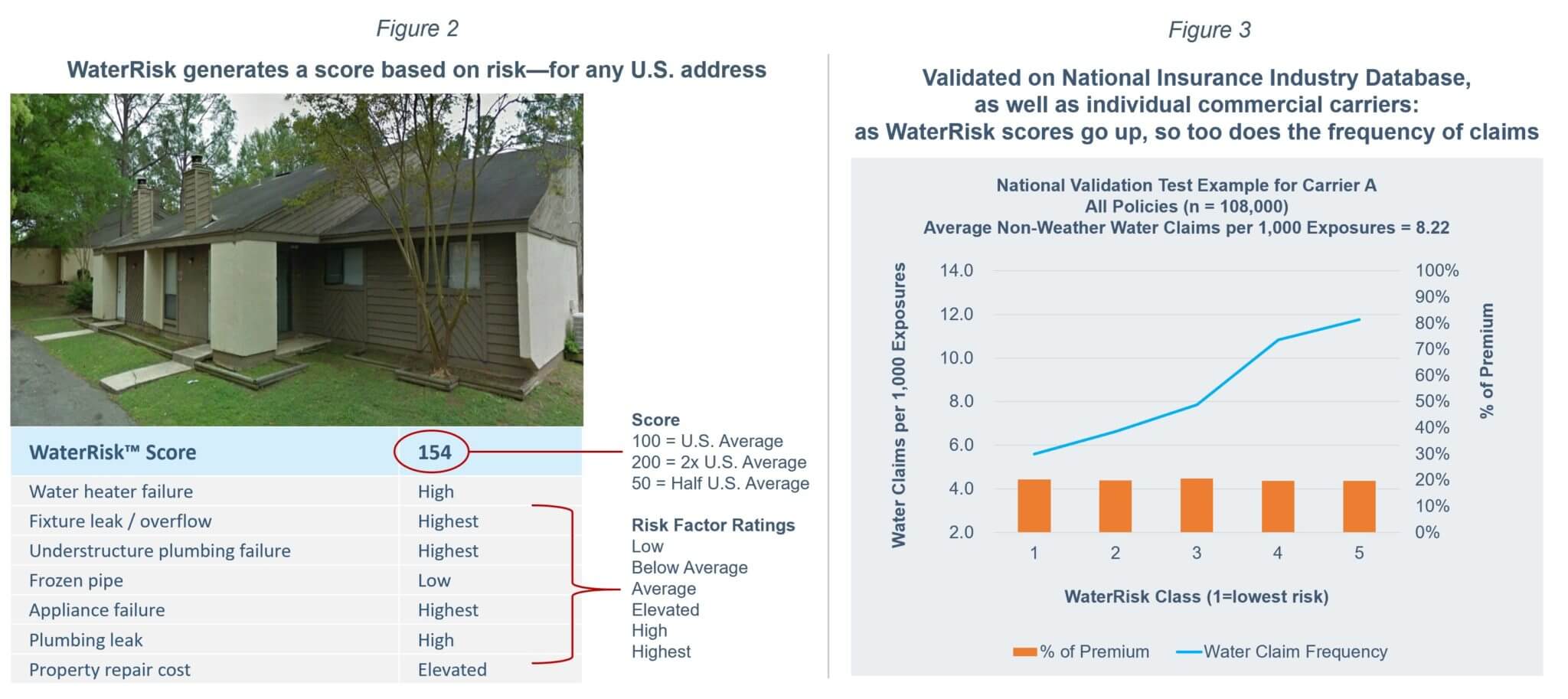

WaterRisk generates a score based on risk—for any U.S. address. This Tallahassee, FL-area address (Figure 2) has a WaterRisk score of 154, which is 54% above the national average score of 100. Listed with the score are factors that contribute to the non-weather water damage risks at the address, to help convey some of the primary reasons why the risk is higher.2

WaterRisk is highly predictive of the frequency and losses from non-weather water damage claims, and has been validated by Location, Inc.’s exclusive national insurance industry database (Figure 3): as the WaterRisk score increases, so too does the frequency of claims. As a result, WaterRisk fills an unquantified gap that accounts for 20% of all commercial property losses.

What WaterRisk can do for you

REQUEST YOUR COMPLIMENTARY PORTFOLIO RISK EXPOSURE ANALYSIS

DISCOVER HOW WATERRISK™ CAN DRAMATICALLY IMPROVE YOUR UNDERWRITING RESULTS

GET STARTED NOW1. “Facts + Statistics: Commercial Lines” from the Insurance Information Institute; “Best’s Aggregates and Averages, Property/Casualty, United States and Canada” (2017) from A.M. Best; a study performed by The Hartford, a financial services company, analyzed claims data from over one million policies purchased by small business owners. The data covered a five-year period (2010 through 2014) and applied to liability, auto and property claims.

2. WaterRisk™ is not a sub-score based index; the factors that contribute to non-weather water damage risks are listed simply to help convey why the risk is low or high for an address but do not quantitatively sum to the WaterRisk score.