“4 Real Estate Market Phases and How They Influence Investing” is our fourth in a series of blog posts on real estate investing. To read more, download our entire eBook, “The Real Estate Investor’s Checklist.”

Like every market, real estate is cyclical. While there is no reliable way to know what the real estate market is going to do, it is important that investors are aware of overall market trends. The past and the present reveal a lot about where we are heading.

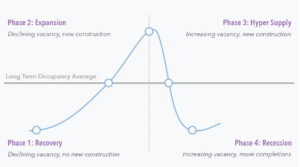

The 4 phases of the real estate market

The real estate market typically moves through four phases before repeating the cycle again (see the graphic below). Knowing which phase the market is currently in enables you to make more educated assumptions regarding future investment opportunities.

Phase 1: Recovery

Arguably, this is the best phase in terms of purchasing investment property. The market is recovering from the last downturn, it is no longer in free fall, and the trend starts to turn upwards. As the old advice goes, you want to buy low and sell high.

High unemployment, foreclosure rates and general uncertainty are typical for this phase. You will hear most people saying, “Oh, I would never invest in real estate.”

Phase 2: Expansion

During the expansion phase, employment starts to pick up and confidence in real estate is once again rising. Lower supply and increasing demand trigger the growth in real estate prices. Developers begin to build new homes.

During the expansion phase, employment starts to pick up and confidence in real estate is once again rising. Lower supply and increasing demand trigger the growth in real estate prices. Developers begin to build new homes.

During this phase, it is still a good time to invest. The problem is that speculators are also involved, so there will be fewer great deals.

Phase 3: Hyper Supply

This is the final stage of the real estate boom. It is characterized by skyrocketing prices, mass building projects, and high interest among the general public in investing in real estate. First the supply and demand reaches equilibrium, then the supply overtakes the demand.

Everyone is making money and bragging about it. Even uneducated investors. This is the time to get out of the market before it crashes.

Phase 4: Recession

This can be an exciting time to buy. After the real estate market bottoms out, it begins to rise once again.

This can be an exciting time to buy. After the real estate market bottoms out, it begins to rise once again.

The timing of your regional market with regard to housing affordability is key. This can be quantified and tracked by understanding the years of the average household income needed to buy the average house in your area.