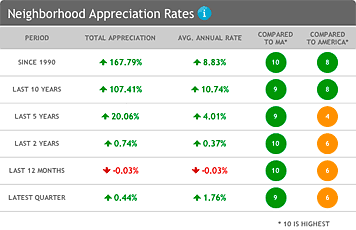

With these data your company will know ahead of time which neighborhoods have the highest home appreciation rates, and which maintain their values.

Location, Inc. provides the only national dataset of neighborhood-specific home appreciation rates available today. Whether you manage a Real Estate Investment Trust (REIT), are a member of a Real Estate Investment Club, or invest in commercial or multi-family real estate, Location, Inc.’s real estate data offers your business valuable insight into real estate investment analytics.

Just type in the address of any property, including those seeking refinancing, home equity lines of credit, or other financial products, and immediately receive accurate and informative real estate statistics that power your business decisions. With these data your company can understand your risk of writing loans based on appraised value now vs. value trends that could leave you and the home owner upside down. These data can also be fed directly into models and considered for part of the approval and rate assignment process. Can also be used for Corporate investment decisions, Real Estate Investment Trusts (REITs), even marketing financial products to homeowners based on projected equity in the homes.

These proprietary real estate value and appreciation rate data are valuable for various industry use, including investing, real estate, mortgage underwriting, appraisals, insurance, relocation, direct marketing, and site selection. Combining these data with our lifestyle and demographic data, crime data, school data, and more, can provide powerful tools for the real estate, mortgage, and site selection industries.

Access: Location, Inc.’s real estate, house values, and appreciation rate data can be pulled by address manually, or direct server-to-server for large volumes. Also available in spatial shape file format for mapping and use behind your company’s firewall. National coverage.

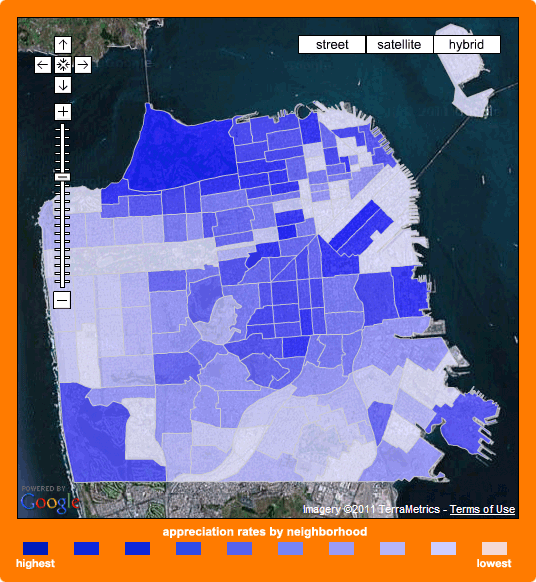

Example: San Francisco Appreciation Rates by Neighborhood

Key Exclusive Data Points – Neighborhood Home Appreciation Rates And Prices

- Neighborhood-specific home appreciation rates for the latest quarter, 1, 2, 5, 10 years and since 1990, for all 61,000 neighborhoods in the U.S.

- Appreciation Rate Index (Neighborhood-Specific) – shows how this neighborhood’s home appreciation rate compares to all neighborhoods in the nation on a 1-100 scale, during each time period.

- Citywide home appreciation rates for the latest quarter, 1, 2, 5, 10 years and since 1990, for all 14,464 cities, towns, villages, boroughs, and hamlets in the U.S.

- Appreciation Rate Index (Citywide) – shows how this city’s home appreciation rate compares to all other cities in the nation on a 1-100 scale, during each time period.

- Statewide home appreciation rates for the latest quarter, 1, 2, 5, 10 years and since 1990, for each state and the District of Columbia.

- Appreciation Rate Index (Statewide) – shows how this state’s home appreciation rate compares to all other states in the nation on a 1-100 scale, for each time period.

- Percentage of homes in any neighborhood within different price ranges

- Rental price comparisons between each neighborhood and avg. rental prices in other neighborhoods in that state, and between other neighborhoods across the nation.

- Forecast Value Trends – Exclusive appreciation forecast rating for every neighborhood on a 1-100 scale.

- Exclusive analysis of the number of months at avg rent are needed to buy the avg home in any neighborhood.