“Investment Property: 5 Questions to Ask Yourself Before Buying” is our first in a series of blog posts on real estate investing. To read more, download our entire eBook, “The Real Estate Investor’s Checklist.”

If done wisely, real estate investing can be a great way to earn income. Whether you’re a novice investor, or you’ve made some deals already, there are five essential questions to ask yourself before purchasing an investment property.

#1. Is The Location Right?

Location is the most important factor to consider in real estate investing. Buying a property in the right location will maximize the chances of it’s value increasing and generating profitable returns.

Most of the time, tenants and buyers will overlook the shortcomings of a property if it has an excellent location. However, no amount of money spent after the purchase will make up for a poor location.

#2. What Are The Demographics?

When it comes to real estate investment, there are many factors smart investors should assess before making decisions. Demographics, are often overlooked in favor of proximity of the location, but they are just as important.

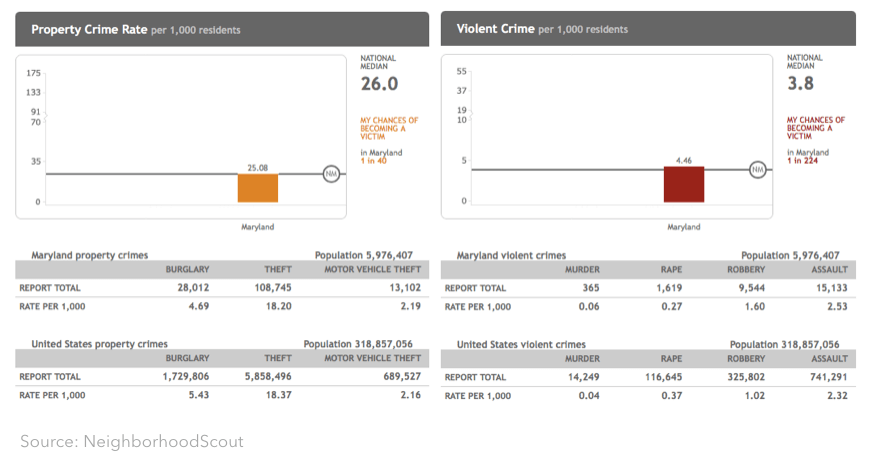

Demographics data, such as age, race, gender, income, crime risk (see image below), school quality, migration patterns and population growth, come together to create the special characteristics of a neighborhood. As a result, major demographic shifts can have a large impact on real estate trends for several decades to follow.

#3. What Market Are We In?

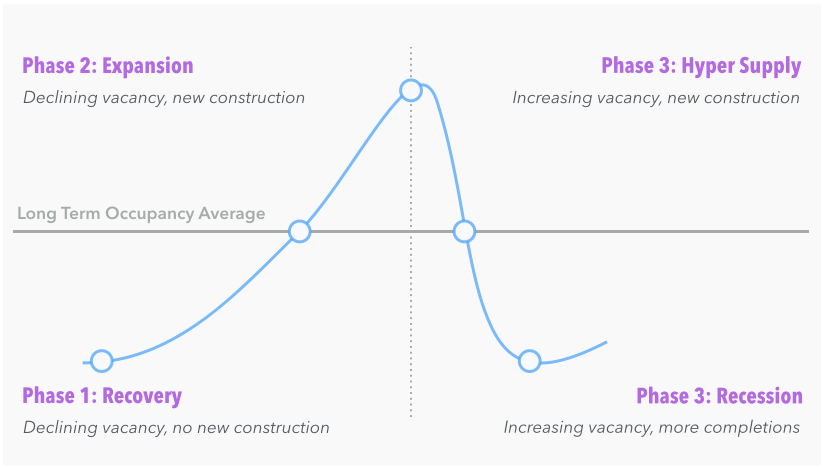

Like every market, real estate is cyclical. While there’s no reliable way to know what the real estate market is going to do, it’s important investors are aware of overall market trends. Past and present trends reveal a lot about where we’re heading.

The real estate market typically moves through four phases before repeating the cycle again. These are recovery, expansion, hyper supply and recession (see image below). Knowing which phase the market is currently in enables you to make more educated assumptions regarding future investment opportunities.

#4. Is The Property In Good Condition?

In most cases, investors are dealing with properties that aren’t new. Even with new construction, you want to perform stringent inspections: Flooring, wiring, phone, cable, and lighting are just a few of the big ticket inspection items.

According to HUD’s 2013 American Housing Survey, the average owner-occupied structure is about 37 years old. With older properties, there’s always a risk for many problems. These include construction quality, climate, geology, roof and window problems, unsafe electricity, plumbing and so on.

#5. Is It A Good Deal?

Once you’ve narrowed down some of the markets and have found interesting properties, it’s time to evaluate deals. The first step to analyzing the value of a property is to understand what contributes to its value. In general, good financial analysis is getting some basic data and feeding it into a financial model.

Then, use that model to determine whether the investment is a good or a bad one. It’s part of your job to make sure you have the best information available when doing your financial analysis.

Remember, it’s often in the seller’s best interest to provide numbers that are more “appealing” than they are accurate, so focus on getting hard data like previous year’s tax returns, property tax bills, and maintenance records rather than pro-forma statements.